The term plan that puts

your family’s future first

IndiaFirst Life

Elite Term Plan

(Non-Linked, Non-Participating Life, Regular Premium, Individual Pure Term Insurance Plan)

Affordable Life Cover + 10% Online discount on 1st Premium + Tax Benefits

Key Benefits of IndiaFirst Life

Elite Term Plan

Protect your family from any financial worry. The IndiaFirst Life Elite Term Plan gives you high cover at a price you can afford. Now money is the last thing your family will have to worry about, whatever the circumstances.

How Does The

Elite Term Plan Work?

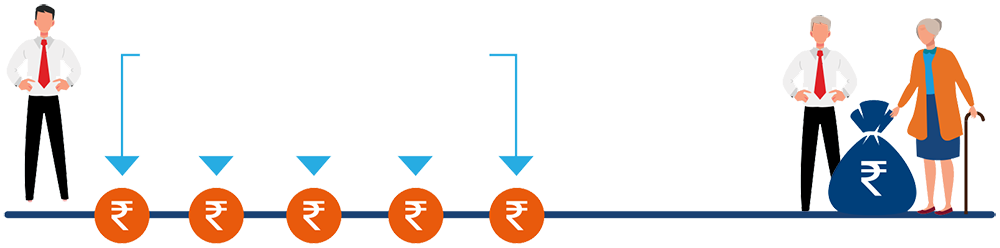

Mr.Jayesh

Age 40

Jayesh is a 40-yr old bank manager with a wife and 8-yr old daughter.

He buys

IndiaFirst Life Elite Term Plan

Jayesh opts for a Sum Assured of Rs. 1 Crore and coverage till age 80 years, to secure his family’s future. As he receives a 10% discount on his 1st year premium, he pays an annual premium of Rs. 26,344 (Inclusive of GST) for the 1st year. He pays an annual premium of Rs. 29,272 (Inclusive of GST) regularly from the 2nd year onwards, at age 42 years.

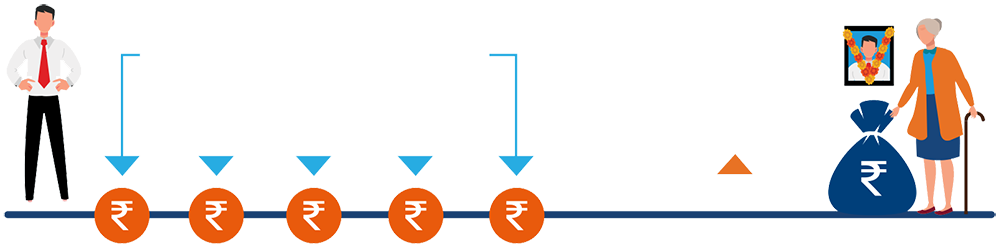

Scenario 1:

Jayesh unfortunately passes away from an illness at age 54 years. His wife, who is the nominee, takes the Sum Assured of Rs. 1 Crore as a lumpsum and the policy terminates.

Total premiums paid by Jayesh – INR 14,04,100 (exclusive of GST)

Total benefits received by the nominee 1 Cr.